2024/2025 FAFSA Updates

There are big changes coming for the FAFSA starting the 2024/2025 academic year.

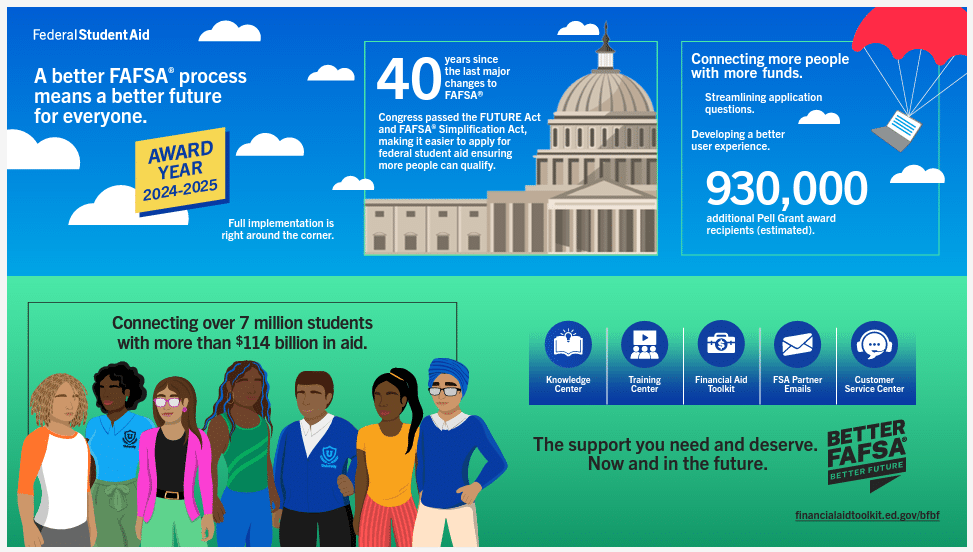

FAFSA Simplification Act

The FAFSA Simplification Act was enacted by Congress as part of the Consolidated Appropriations Act of 2021. This law reduces the number of questions students will have to answer on the form, makes crucial changes to the Higher Education Act of 1965 to expand Pell Grant eligibility and removes outdated restrictions to make federal student aid more accessible to all students.

Prepare for the FAFSA

- Create an FSA ID for yourself and encourage any contributors, such as your parent(s) or spouse, on the Federal Student Aid website to create their FSA ID.

- There will be a tool for the students to use through the process to determine which parent(s) should be invited as a contributor.

- Check this FAFSA Simplification page often for updates. We will keep this page up to date with the latest information.

- Complete the FAFSA as soon as it opens in December.

Who Needs an FSA ID Infographics:

2024/2025 Naropa Financial Aid Timeline

FAFSA Opens

Apply for Naropa Scholarships

2024/2025 Award Notification

Sign Offer Letter

What Changes are coming?

2024/2025 FAFSA is now open.

Due to the delayed release of the 2024-25 FAFSA and the projected timelines for schools to begin receiving FAFSA results, Naropa University anticipates starting to send offer letters towards the end of Spring. Thank you for your patience.

With these major changes, the U.S. Department of Education’s Office of Federal Student Aid delayed the release until January 1st, 2024, three months after the usual October 1 release.

The delay will have some clear implications that you should prepare for. This is the largest FAFSA overhaul in recent years, and it will require not only the federal government to implement changes to their processes, but states and schools need to prepare for the change as well.

- Anyone who is required to provide information on the FAFSA is referred to as a Contributor.

- All contributors will need their own Federal Student Aid (FSA) ID. For dependent students from divorced/separated families, there has been a change as to which parent is required to provide information on the FAFSA as a Contributor. There will be a tool for the students to use through the process to determine which parent(s) should be invited as a contributor.

- Parents without Social Security Numbers are required to create and use a FSA ID to complete their portion of the FAFSA.

- You can create an FSA ID, right now to prepare things in advance. This will help expedite the process as it takes up to 3 business days to verify FSA IDs

- **IMPORTANT NOTE**Parents without SSNs are not yet able to create their FSA IDs, but please keep checking the FAFSA for updates on that.

For more information, please check out our FAQs about FSA IDs below.

The Student Aid Index (SAI) will replace the Expected Family Contribution (EFC) as of the 2024-2025 award year. The SAI reflects an evaluation of a student’s approximate financial resources to contribute to the student’s post-secondary education for an academic year.

Notable changes to the federal SAI methodology include the following:

- The new formula allows a minimum SAI of negative $1,500 to give more insight when making determinations for a student’s aid.

- The number of children in college is not considered in the SAI calculation.

- The formula reduces the number of data items and allowances against income, with untaxed income data items being removed from the FAFSA.

- Allowances (amounts subtracted) against assets will be based on the age of the older parent in two parent households.

- Annual child support received will now be an asset and reported based on the last complete calendar year. Which year is used will be based on when the FAFSA is completed. For example, if the FAFSA is completed in December 2023 when it opens, child support received would be reported from 2022 totals. But, if the FAFSA was completed in 2024, the child support received would be reported from 2023 totals.

- Business net worth will now be reported regardless of the size of the business.

- Family Farm net worth will now be reported, except for the part of the farm that is the family’s primary residence, which should be deducted from the total net worth (more guidance will be given by the Department of Education on this calculation with the 2024-2025 FAFSA directions).

- The applicant’s family size will be based on the tax data used for the FAFSA application and downloaded directly from the IRS. The Contributor will have the ability to update the family size if the number has changed since the tax year of the federal tax information (FTI) being downloaded. (Note: The tax information downloaded for each contributor will be based on the prior-prior tax year, which is consistent with the current practice. For 2024-2025, it would be two years back from the base year of 2024, which would be the 2022 tax year.)

- The contributing parent providing consent for the tax data being used in the calculation has changed and is no longer the parent the student lives with most, but instead the parent who provides most financial support. There will be a tool for the students to use through the process to determine which parent(s) should be invited as a contributor.

Contributors are required to give consent to have their federal tax information (FTI) transferred from the IRS. Consent authorizes direct access and disclosure of IRS data and allows for disclosure of that information to state entities, institutions and scholarship organizations.

If any contributor refuses to give consent, the student will be ineligible for federal, state, and institutional need-based financial aid.

Starting 2024/2025 FAFSA, the DRT will no longer exist.

After the student, spouse, and/or parent provides consent to the Direct Data Exchange (FADDX), the Federal Tax Information (FTI) will be linked to the application contributor. Federal Student Aid (FSA) will now directly transfer Federal Tax Information (FTI) from the IRS into the FAFSA form as long as the user has provided FSA with the consent to do so.

**Important Note** For situations where the tax return was filed jointly (i.e. biological and/or step-parents filed “married filing jointly”) in the prior-prior year, only one parent would need to establish an FSA ID to provide consent. For independent students who are married, if they filed jointly with their spouse in the prior-prior year, only the student will need to consent. However, if the filing status was “married filing separate,” or if the Contributors originally filed single in the prior-prior year, but are now married, both parties would need an FSA ID and need to provide consent. There will be a tool for the students to use through the process to determine which parent(s) should be invited as a contributor.

For more information, please check out our FAQs about Consent and Taxes below.

Parent(s) on FAFSA:

For students from divorced/separated households, the law has changed as to which parent is to complete the FAFSA. The law now requires the parent who provided the greater portion of the student’s financial support during the prior 12 months to complete the FAFSA. The new FAFSA application will have a “Who is my parent?” wizard tool to assist students in determining which parent should be included as a contributor. If the parent who provides the greater financial support has remarried, the step-parent’s information must also be included. In the case where both parents provided equal support, then the parent with the greater income will be the required contributor on the FAFSA.

Family Size:

Family Size will be based on the family size that the family entered, if different from the taxes. Students may have to provide additional information if selected for verification.

Federal Work-Study (Student Employment):

The work-study interest question has been removed from the 2024-2025 FAFSA. Students who have demonstrated need (Cost of attendance – Student Aid Index – Other Financial Assistance > $0) will be offered federal work-study (FWS) as part of their financial aid offer.

Cost of Attendance Components:

The Act has changed some terms used in cost of attendance information, as well as added the ability to receive additional budget consideration for some components related to cost of attendance.

- Room will now be referred to as “Housing” on the cost of attendance information.

- Board will now be referred to as “Food” on the cost of attendance information.

- Additional provisions have been added to allow for increased cost of attendance budget considerations for costs associated with a professional licensure, certification, or a first professional credential if paid for during a term of enrollment, as well as reasonable allowances for books, course materials, supplies, and equipment that may be unique to a student’s course of study.

SAI (Student Aid Index): The calculated result of running the federal methodology formula and used to award federal aid (may be used to calculate Pell Grants in the Min/Max Pell determination is not the best for the student). Forget: EFC (Expected Family Contribution).

Contributors: The new word that will be used for anyone who is required to provide information on a FAFSA. Forget: Using the word “parent” or “student” to describe whose information you still need to collect.

FADDX (Financial Aid Direct Data Exchange): The new name for bringing over applicant/parent information from the IRS. Forget: IRS DRT.

Family size: Will be determined by the number of exemptions claimed on federal tax returns from the IRS.. (Note: There will be an option to change that number if it no longer reflects the accurate family size). Forget: Household size.

FPS (FAFSA Processing System): The new name for the platform processing the forms. Forget: CPS (Central Processing System) is being retired.

FTI (Federal Tax Information): All FTI transferred will be encrypted to the applicant but made available to the institutions. There are several additional restrictions related to sharing FTI which will require us all to learn more about those. In general, FTI cannot be redisclosed. Forget: Seeing any income information on SARs for most applicants.

Frequently Asked Questions about FAFSA Simplification

What are Contributors on the FAFSA 2024-25?

Contributor is a new term introduced on the 2024-25 FAFSA form. It refers to anyone asked to provide information on a student’s FAFSA form, i.e., the student, the student’s spouse, a biological or adopted parent, or the parent’s spouse (stepparent).

A Contributor is NOT a grandparent, foster parents, legal guardian, brother or sister, aunt or uncle, even if they helped provide for or raise the student.

A Contributor on the FAFSA form doesn’t mean they are financially responsible for the student’s education costs.

How are Contributors determined?

The student’s or parent’s answers will determine which contributors (if any) will be required to provide information.

What do Contributors need to provide?

These contributors will be invited to complete their portion of the FAFSA form by entering their name, date of birth, Social Security number, and email address. They must also provide personal and financial information in their own sections of the FAFSA form.

What are the steps Contributors must follow?

- Contributor receives an email informing them that they’ve been identified as a contributor.

- Contributor creates a StudentAid.gov account if they don’t already have one.

- Contributor logs in to account using their FSA ID account username and password.

- Contributor reviews information about completing their section of the FAFSA form.

- Contributor provides the required information on the student’s FAFSA form.

What if I am a Contributor and don’t want to provide my information in my student’s FAFSA?

Being a contributor does NOT implicate financial responsibility. However, if a required contributor refuses to provide their information, it will result in an incomplete FAFSA form, and the student will become ineligible for federal student aid.

What if my parents are divorced? Who is the contributor to my FAFSA?

Students that live with a single/divorced/widowed parent and receive most support from that parent, will report only one parent on the FAFSA.

The parent included in the FAFSA as a contributor must be the parent that provides the greater portion of the student’s financial support. If that primary parent is remarried, the income of that parent’s spouse (stepparent) will also be required.

Why does the FAFSA 2024-25 require consent from students and contributors?

According to the Future Act, all students and contributors must provide consent to the following:

- Have their federal tax information transferred directly into the FAFSA® form via direct data exchange with the IRS;

- Have their federal tax information used to determine the student’s eligibility for federal student aid; and

- Allow the U.S. Department of Education to share its federal tax information with postsecondary institutions and state higher education agencies for use in awarding and administering financial aid.

Important: Even if students or contributors don’t have a Social Security number, didn’t file taxes, or filed taxes outside of the U.S., they still need to provide consent.

What if I don’t want to provide consent as a student or a required contributor?

- If a student or required contributor doesn’t provide consent to have their federal tax information transferred into the FAFSA® form, the student will not be eligible for federal student aid—even if they manually enter tax information into the FAFSA form.

- Information about how federal tax information will be used and the consequences of not providing consent will be included on the FAFSA form.

- Legal parents must provide consent to transfer federal tax information, even if one of the parents didn’t file or had no income. If parents fail to provide consent, the student won’t be eligible to receive federal student aid.

What is FSA ID, and who needs it?

- All students and contributors must create a StudentAid.gov account to complete the FAFSA form online.

- Students and contributors will use their FSA ID account username and password to log in to their accounts.

- Even if a parent or spouse contributor doesn’t have a Social Security number, they can still get an FSA ID using their ITIN to fill out their portion of the student’s FAFSA form online.

Do parents and students need to wait until FAFSA 2024-25 opens in December to create an FSA ID?

No. The FSA ID process is not changing. It’s even better that parents and students can create the FSA ID and have it ready any time before the FAFSA application starts.

How do I or other contributors create an FSA ID?

To create an FSA ID, you’ll need your Social Security number (SSN). Other information required is full name and date of birth. You’ll also need to create a memorable username and password and complete challenge questions and answers to retrieve your account information if you forget it. You’ll be required to provide your email address or mobile phone number when you make your FSA ID. Providing a mobile phone number and/or email address that you have access to will make it easier to log in to ED online systems and allow you to verify your FSA ID before using it on the FAFSA and additional account recovery options.

This Federal Student Aid video can help create a step-by-step FSA ID.

Do parents without social security numbers also need to have an FSA ID?

Yes. Starting 2024-25, parents and/or spouses who are not U.S. Citizens or Eligible Noncitizens can use their Individual Taxpayer Identification Number (ITIN) to create an FSA ID once their taxes are still required.

What if my parents are not in the United States?

Your parents’ citizenship status doesn’t affect your eligibility for federal aid. They cannot create an FSA ID, but you can complete the FAFSA on paper and ask for their signatures. For FAFSA purposes, you must provide your parents’ income, no matter where they reside.

My parent remarried. Is the parent’s spouse required to get an FSA ID as well?

If the parent you indicate on the FAFSA is the parent who remarried, it’ll depend on how they filed taxes. If they filed jointly, only one parent needs an FSA ID. If they filed separately, both parents would need their own FSA ID.

Will parents and students need to create a new FSA ID if they have had an FSA ID in the past?

No. You can retrieve your existing FSA ID if you forgot your username and password.

I created an FSA ID at a FAFSA night at my high school and could not use it immediately. Do you recommend creating it a few days before?

We have seen different situations when a parent creates their FSA ID, verifies it, and is ready to use, and sometimes the system asks them to wait 24-48 hours to use it. It depends on the information matching system.

We recommend creating it a few days before starting the form. FSA IDs made on the day of might work but will not have full functionality yet, like using the Direct Data Exchange (FADDX) to transfer tax information.

Why do I have to set up two-step verification for my StudentAid.gov Account?

Two-step verification, a form of multi-factor authentication (MFA), helps protect your StudentAid.gov account with additional protection from fraud.

So each contributor needs a unique phone number or email for multi-factor authentication?

Yes! For example, a student and parent cannot use the same phone number for MFA.

Do both parents need to create FSA ID or just one like before?

This depends on the family’s situation. For example, if a student has married parents filing taxes separately, both parents will need to make an FSA ID.

What is the impact if the student and parent already have an FSA ID?

None. Just ensure they are verified and ready to use when the FAFSA 2024-25 opens sometime in December 2023.

If a parent does not want to or refuses to create an FSA ID, is there an alternative for that parent to provide consent, such as mailing a wet signed consent page?

Starting 2024-25, a separate signature page will no longer exist. There are two alternative options for contributors to provide consent who do not want to or refuse to create an FSA ID:

- The first example would be the student applying using the paper FAFSA and obtaining wet signatures from all contributors, including the parents, who also affirm their consent.

- The other option is for the student completes their section and self-reports information for the parent section on the FAFSA form. When the student submits their FAFSA form without the parent’s signature, it will be placed in rejected status by the FAFSA Processing System (FPS). The parent can then provide their signature and consent on a paper copy of the FAFSA Submission Summary. Now this method is not recommended due to complexity and increased processing time.

What is consent, and why do I have to provide it when completing the FAFSA 2024-25?

The Future Act requires that every contributor on the FAFSA provide consent to share their taxes information in the application so that the IRS can share this information with Federal Student Aid (FSA). All parties whose Federal Tax Information (FTI) is included on a student’s FAFSA form must consent annually.

The consent will be required when a student submits a FAFSA, chooses Income-Driven Repayment (IDR) when starting loan repayment, or submits the Total and Permanent Disability discharge (TPD) within the U.S. Department of Veterans Affairs for totally and permanently disabled students.

The consent is necessary not only for the Department of Education to request federal tax information from the IRS but also to use that FTI in the federal student aid application process, as well as do other things such as redisclose that information to certain eligible entities, such as higher education institutions.

What happens if I, as a student, or a spouse or parent, don’t want to provide consent on the FAFSA?

If a student, spouse, or parent doesn’t provide consent on the FAFSA, the Student Aid Index (SAI) will not be calculated, and the student will not be eligible for any federal aid.

What if I had a low income and was not required to file taxes?

According to the IRS tax year 2022, these are the thresholds by filing status. If an independent student (and spouse, if married), or a parent of a dependent student, were not required to file a federal income tax return for 2022, then the student will automatically receive a Student Aid Index (SAI) equal to –1500. They still need to provide consent when submitting the FAFSA, so the IRS can confirm to Federal Student Aid (FSA) the student, parents, and spouse didn’t file taxes.

Will students still be able to use the IRS Data Retrieval Tool?

No. Starting FAFSA 2024-25, the DRT will no longer exist. After the student, spouse, and/or parent provides consent to the Direct Data Exchange (FADDX), the Federal Tax Information (FTI) will be linked to the application contributor. Federal Student Aid (FSA) will now directly transfer Federal Tax Information (FTI) from the IRS into the FAFSA form as long as the user has provided FSA with the consent to do so.

All users identified as required contributors on a particular FAFSA form will be prompted to provide consent for the IRS to use their Federal Tax Information (FTI). This consent is required to retrieve FTI from the IRS to calculate the student’s aid eligibility. If any party to the FAFSA form does not provide consent, submission of the form will still be allowed. However, a Student Aid Index (SAI), which replaces the Expected Family Contribution (EFC), will not be calculated.

Will non-custodial parents be contributors if they have not claimed the child on their taxes?

Starting with the Simplified FAFSA, students will determine which parent to report based on which one provides the most financial support. It is ok if the parent or parents reported do not claim the student on their taxes. The reported parents will provide consent to transfer their taxes data even if they do not claim the student on their taxes.

If parents that are remarried provide more support to the child than a biological parent, does the stepparent have to provide their taxes information?

Yes. If the parent providing more financial support is remarried, the stepparent’s tax information is required.

What if my parent or stepparent does not want to provide their tax information for my FAFSA?

Our Federal Aid Counselors can offer to talk directly with the parent or stepparent to explain why that information is needed and answer any questions, which sometimes puts them at ease about how their sensitive info will be used. However, we cannot provide tax advice.

How do I report small business or farm value as assets on the FAFSA?

Independent students or parents are the best sources for this estimate; they can also consult their accountant or other financial professional if they have access to one to estimate the amounts to report.

My parent is self-employed — do they still need to say they own a business?

Being self-employed does end up showing business income on tax returns. But it depends on the type of work whether or not they will have to report any assets associated with their business.

I – and/or my parents or spouse – amended our taxes. Will my Federal Tax Information (FTI) be transferred, or do I have to provide a 1040X later to the school?

Yes. Starting 2024-25, when the student, spouse, parent, and/or stepparent provide consent, the IRS’s Federal Tax Information (FTI) will include the information from an amended tax return.

Can I self-report my income on FAFSA?

After you provide consent on the FAFSA, if the IRS cannot transfer your Federal Tax Information (FTI) to your FAFSA application, the application will allow you to self-report it. Self-reporting one’s tax information on the FAFSA does not override the requirement for each required contributor to provide consent on the FAFSA form. So two pieces – they need to provide consent, and we need to have their tax information, either directly from the IRS or self-reported manually on the FAFSA form.

If a parent of a dependent student or an independent student is a non-filer and has zero wages, do they have to provide consent?

Any individual who is a contributor to the FAFSA application must provide consent. This includes parents, and independent students, regardless of their tax filing status. Generally, the parents of independent students are not contributors and would, therefore, not need to provide consent.

What happens if a contributor provides consent but doesn’t sign the application?

Starting 2024-25, there will be only two options for filing a FAFSA form: electronically, through studentaid.gov, or the option to file on paper which will also be available. However, once an application is started online, all parties must complete it online. So that means that if a signature is missing, the parent or the contributor that needs to complete their section and/or sign the application must obtain an FSA ID and get into the application and complete their section.

There is no option to print a signature page any longer. For this reason, financial aid administrators will not be able to submit complete FAFSA forms because of the consent provision that all contributors must provide and sign.

Students and parents will be required to have an FSA ID to complete the FAFSA application online. If they choose to mail a paper FAFSA, both will need to provide consent on the paper FAFSA, and both will need to provide wet signatures and mail the application to the Department of Education address on the paper application. This method is not recommended due to complexity and increased processing time.

In what situations will there be a match with IRS, but IRS wouldn’t provide information?

Fraud or identity theft are the most likely reasons for the IRS not providing tax information to the applicant or the contributor. If the contributor has been flagged by the IRS, possibly due to identity theft or a breach of some sort to their information, then the IRS response code will be IRS enabled to provide information.

If a parent does not want to or refuses to create an FSA ID, is there an alternative for that parent to provide consent, such as mailing a wet signed consent page?

There is no longer a separate signature page, and there won’t be a consent signature option on paper. There are two alternative options for contributors to provide consent who do not want to or refuse to create an FSA ID. One option is to submit a paper FAFSA form completed by all contributors and mailed to the Federal Student Aid. This method is not recommended due to complexity and increased processing time.

What is the Student Aid Index (SAI)?

SAI, or Student Aid Index, is replacing the term Expected Family Contribution, known as EFC. The SAI brings a change in the methodology used to determine aid.

- The SAI is a number used to determine eligibility for need-based aid. It is calculated using information the student (and contributors, if required) provides on the FAFSA form.

- The SAI will replace the Expected Family Contribution (EFC) starting in the 2024–25 award year.

- A student’s SAI can be a negative number down to –1500.

Important: Your federal award equals Need= Cost of Attendance (COA) –Student Aid Index (SAI) –Other Financial Assistance (OFA).

What is the main difference between the SAI (starting FAFSA 2024-25) and EFC (used until FAFSA 2023-24)?

The Student Aid Index (SAI) represents a change in the methodology used to determine aid:

- Child support received will now count as an asset instead of income.

- Family farms and small businesses will now count as assets.

- The number of family members in college is no longer considered in the needs analysis formula, but it is still a required question on the FAFSA® form.

Additional information on the SAI formulas can be found in the 2024-25 DRAFT Pell Eligibility and SAI Guide.

How is Pell Grant eligibility determined?

Maximum Pell Grant – Students may qualify for a maximum Pell Grant based on family size, adjusted gross income, poverty guidelines, and tax filing status. Students qualifying for a maximum Pell Grant will have a Student Aid Index (SAI) between –1500 and 0.

Student Aid Index (SAI) – Students who don’t qualify for a maximum Pell Grant may still be eligible if their calculated SAI is less than the maximum Pell Grant award for the award year. The student’s Pell Grant award will be equal to the maximum Pell Grant for the award year minus their SAI.

Minimum Pell Grant – Students whose SAI is greater than the maximum Pell Grant award for the award year may still be eligible for a Pell Grant based on family size, adjusted gross income, and poverty guidelines.

What if I had a low income and was not required to file taxes?

According to the IRS tax year 2022, these are the thresholds by filing status. If parents of a dependent student or an independent student (and spouse, if married) were not required to file a federal income tax return for 2022, the student will automatically receive a Student Aid Index (SAI) equal to –1500.

Why are Assets different on the FAFSA® 2024-25?

For the 2024–25 award year, some financial information previously considered income will be considered as assets. Also, some information not requested previously, like the family’s small business, will no longer be excluded from asset reporting.

If students get a negative SAI, will they get a higher Pell Grant?

Students with a negative or 0 SAI will be eligible for the maximum Pell Grant. The difference is that the negative -1500 SAI indicates the student has a higher need than the student with 0 SAI, being eligible for other grants, if available, like Federal Supplemental Educational Opportunity Grant (FSEOG).

If the family size is manually adjusted, will the SAI only be calculated based on the size drawn from the taxes?

It will be based on the family size that the family entered, if different from the taxes. Students may have to provide additional information if selected for verification.

What is the parallel between the 2024-25 Negative SAI and Pell Grant?

| Negative SAI | Pell Grant – Max/Min Determined by |

|---|---|

|

|

How will Pell Grant be awarded?

Pell grant will not be awarded per enrollment category any longer, but per amount of credits.