Policies

Program Information

Enrollment Status

Financial aid is awarded based on the intended enrollment status indicated by the student on the FAFSA or other correspondence. Financial aid eligibility may be different for full-time (at least 12 credits for undergraduates, 9 credits for graduates), half-time (at least 6 credits), and for undergraduates three-quarter-time (9 credits). Students must notify the Financial Aid Office immediately of any change in enrollment status, so that financial aid may be adjusted. Please be aware that the definition for half-time and full-time status is the same for summer as for fall and spring. If students are enrolled less than half-time (6 credits) for any semester, including summer, they are not eligible for financial aid for that semester. Exception: PELL-eligible undergraduates may be eligible for partial PELL grants even if enrolled less than half-time. Students who are registered for extended thesis or manuscript are not eligible for financial aid.

If students have ever received financial aid while attending Naropa, and drop below half-time status, withdraw, take a leave of absence or graduate, they must contact the Financial Aid Office immediately, and complete an exit interview before leaving the university.

Appeals

All students have the right to appeal a financial aid ruling, or appeal for more aid than was awarded in the financial aid eligibility letter. We want to work with all students who are struggling financially to work with budgeting and where possible to identify additional sources of aid. All appeals must be made in writing to the Financial Aid Office.

Supporting documentation may be requested as necessary. The Financial Aid Office will review the appeal and notify students if the appeal has been approved or denied. If any changes are made to their financial aid eligibility, they will receive a revised financial aid eligibility letter. Decisions made regarding an appeal apply to the current academic year only.

Satisfactory Academic Progress

It is essential that students familiarize themselves with the following policy, as it affects not only current financial aid eligibility, but future aid as well.

Conditions for Maintaining Satisfactory Academic Progress

All students who wish to qualify for financial aid while attending Naropa University (NU) must meet certain standards of Satisfactory Academic Progress (SAP), even if they have not used financial aid previously. These standards include a minimum cumulative Grade Point Average (GPA), a minimum credit hour completion rate (PACE), and the completion of a degree or program of study within a maximum time-frame.

Minimum Credit Hour Completion Rate (PACE)

All students must earn a minimum of 67% of the credit hours that they have attempted, including transfer credit hours and semesters the student did not receive aid. The credit hour completion rate is calculated by dividing total earned credit hours by the total number of credit hours attempted.

Example: A student has attempted a total of 24 credit hours at NU (transfer credits included). In order to meet the minimum credit hour completion rate requirement and be eligible for financial aid for future semesters, the student must have earned 16 of those credit hours (24 x 67% = 16).

Minimum Cumulative Grade Point Average (GPA)

In order to receive federal financial aid or other need-based aid, a student’s cumulative grade point average (GPA) must meet the minimum requirement as defined below:

Certificate | 2.0 |

Undergraduate | 2.0 |

Graduate | 2.7 |

Maximum Time-Frame Requirement

Due to Federal regulations, students are allowed a maximum time frame of 150% of the number of credits needed to complete the degree or certificate program. This time frame is effective for all students, even those that have not previously received financial aid. Students who exceed the limit are no longer eligible for further aid. Reinstatement of eligibility requires the student to submit an appeal to determine aid eligibility.

Example

If an undergraduate degree program requires 120 semester credit hours to complete, then a student is eligible for financial aid during the first 180 attempted credit hours as an undergraduate (120 x 150% = 180 maximum attempted credit hours for financial aid eligibility).

Students who need additional time to complete their degree must complete a SAP Appeal. A letter regarding why the student has not completed the degree, an advisor/department chair letter explaining what classes remain, what terms they will be taken in, and the student’s expected graduation date must accompany the appeal.

Students who change their major, or add a dual major, will be evaluated in the same manner as all other students. All periods will count towards the maximum timeframe and cumulative GPA evaluation for SAP. For students who have a previously conferred degree, and are completing a second degree, no transfer credit will be accepted from the completed degree; therefore, the previous degree will be excluded from SAP evaluations.

The Effect of Incompletes, Withdrawal Grades, Repeated and Remedial Coursework

If a student receives an incomplete grade, that grade will count against the student’s PACE, until the grade has been updated. After the grade has been updated, PACE will be re-evaluated to determine if the student is now meeting SAP.

If a student withdraws from a class after the drop/add period, those credit hours for which the student earns a grade of “W” are counted as attempted, but not earned, credit hours. Therefore, withdrawing from classes after the drop/add period, without earning a passing letter grade, will negatively affect the student’s PACE.

A student may receive federal financial aid for a repeated failed course. Students may also receive aid for a repeated course that was previously passed (credit has been received, but taken again for a higher grade) only once. Every repeated course affects Satisfactory Academic Progress calculations; all repeated courses are counted as attempted credits.

Remedial courses are not offered, or accepted as transfer credit, at Naropa University. Remedial courses, therefore, are not applicable to a student’s SAP evaluation.

Failure to Meet Satisfactory Academic Progress

The financial aid SAP eligibility standard will be evaluated at the end of each term for financial aid applicants. If a student enrolls in coursework over the summer, SAP will be evaluated at the end of the summer term.

Warning Status

When a student fails to meet the eligibility standards for either completion rate and/or cumulative GPA, a “Warning” status is enforced. A notification of this status will be sent to the student’s official Naropa student email. This notice will detail the change of eligibility status and the potential impact it may have on future aid eligibility. If a student in “Warning” status fails to meet either completion rate or cumulative minimum standards for another term, the student becomes ineligible for aid.

Financial Aid Suspension

A student in “Warning” status who has failed to meet either the completion rate or cumulative minimum standards at the end of the next evaluation period will be placed on financial aid “Suspension” and will no longer be eligible for any federal, state or institutional aid until SAP eligibility standards are met.

Reinstatement of Aid Eligibility

Students may re-establish their eligibility for financial aid by improving their academic standing in the subsequent evaluation period, without receiving financial aid. If the student on “Suspension” meets Satisfactory Academic Progress standards the following term, the “Suspension” is replaced by a status of financial “Probation” and the student regains financial aid eligibility.

Appeal Procedures

A student may appeal the suspension of financial aid eligibility. Students, who wish to appeal, must submit a narrative detailing the below items, and provide supporting documentation (if needed).

- Why they failed to meet SAP standards in each of the relevant semesters.

- What has changed about their situation that will ensure problems will not arise again.

- How the student plans to meet SAP requirements once again.

Students should submit the appeal narrative and all required documentation directly to the Office of Financial Aid (finaid@naropa.edu). Appeals should be made in a timely manner.

A committee will review each appeal on an individual basis to determine what prevented the student from meeting satisfactory academic progress. The review will take into account prior appeals submitted; the thoroughness of documentation; student’s current cumulative GPA; student’s current completion rate; length of time until the student’s program is complete; resolution of all extenuating circumstances and an explanation of all semesters in which the student failed to meet standards.

Students are responsible for the completeness of their appeal. Appeal requests may be denied because the application is incomplete, there is not enough or adequate documentation to support the reason for the appeal, or the student fails to explain how the problem has been addressed.

Appeal Decisions

A written notification of the decision will be sent to the student’s official Naropa email account, by the Office of Financial Aid. Successful appeals will allow a student to be placed on Financial Aid “Probation” status. The student must, if applicable, meet the probation status conditions outlined in the appeal decision. A Letter of Notification of Reinstatement of Financial Aid sent to the student will give the conditions and/or an academic plan the student must achieve per semester.

Financial Aid Probation Determinations

Students placed on financial aid probation will receive one of two probation determinations:

Financial Aid Probation

An approved appeal places the student on Financial Aid Probation. The probation period is one term only and the student MUST meet SAP standards at the conclusion of the probation term. Student’s progress will be reviewed at the conclusion of the assigned semester. Failure to meet requirements will result in immediate suspension of aid eligibility and future appeals may be denied.

Financial Aid Probation with Academic Plan

This probation is an approved appeal that requires students to not only meet SAP standards, but to also adhere to an approved academic plan with assistance from an academic advisor. Typically this plan will include reporting regularly to their academic advisor to discuss any problems that may be a hindrance to academic progress, seeking assistance in defining and implementing a plan to meet future educational goals, a limitation of 12 credit hour course load during the probation period, and signing a statement of understanding and agreement to comply to all stipulations.

For financial aid purposes, a student who has been reinstated to eligibility under an academic plan and is making progress under that plan is considered to be an eligible student. Students who withdraw without extenuating circumstances while on an academic plan will not be allowed to appeal until they have met all SAP requirements.

Denied Appeals

Denial of the appeal will mean the student is not eligible for financial aid benefits; however, a student may enroll in subsequent semesters at his/her own cost. Financial Aid eligibility may be reinstated once all satisfactory academic progress minimum standards are met.

If an appeal was denied students will only be able to appeal again after the successful completion of at least one semester. Successful completion requires a passing grade in the course(s) as required for the degree program or transfer credit. Successful completion will not result in automatic reinstatement of eligibility as the entire academic history will be taken into account when evaluating SAP. Sometimes two, three or more semesters of successful completion are required to meet SAP or appeal standards. In some cases, students may never regain eligibility at Naropa University.

Factors Affecting Aid Eligibility

Naropa University will not award aid to any student who is in default, who owes a refund, or who commits fraud.

Drug Conviction

The Anti-Drug Abuse Act of 1988 includes provisions that authorize federal and state judges to deny certain federal benefits, including student aid, to persons convicted of drug trafficking or possession.

If you have been convicted of a drug related offense that causes you to be ineligible for federal financial aid, you will be notified from the report of your FAFSA information, as well as our Financial Aid Portal on what steps you must take to resolve the issue.

Withdrawing from Naropa

Tuition Refund Policy

Add/Drop Period

When you complete the FAFSA, you will be asked whether you had a drug conviction for an offense that occurred while you were receiving federal student aid. If the answer is yes, you will be provided a worksheet to help you determine whether your conviction affects your eligibility for federal student aid.

If your eligibility for federal student aid has been suspended due to a drug conviction, you can regain eligibility early by successfully completing an approved drug rehabilitation program or by passing two unannounced drug tests administered by an approved drug rehabilitation program. If you regain eligibility during the award year, notify your financial aid office immediately so you can get any aid you’re eligible for.

If you are convicted of a drug-related offense after you submit the FAFSA, you might lose eligibility for federal student aid, and you might be liable for returning any financial aid you received during a period of ineligibility.

Withdrawal Period

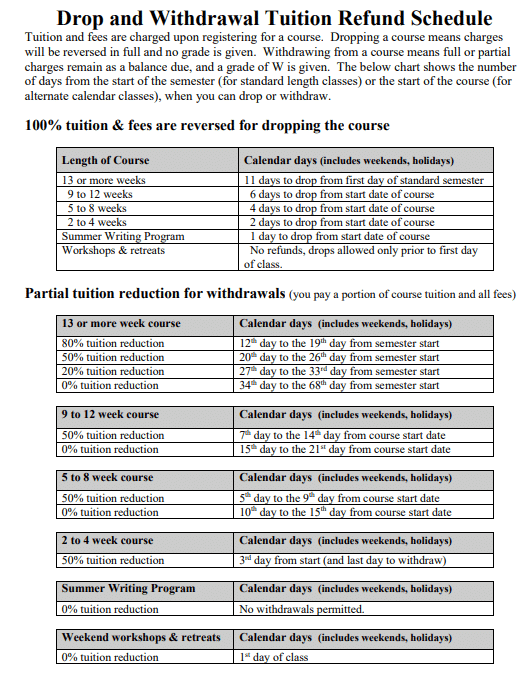

Students may withdraw from (but not add) courses during the withdrawal period. For most courses, the withdrawal period begins on the tenth day of classes and ends during the sixth week of classes for the fall and spring semesters. Some courses with irregular start or end dates have different deadlines. These deadlines are listed in the course schedule. The summer withdrawal period is significantly different for each course, and is printed in the summer schedule of classes. If a student withdraws from a course during this period, the grade of “W” for “withdrawal” will appear next to the course title on the student’s transcript. A partial reduction of tuition may apply. Fees are not refunded in the withdrawal period.

Beginning with the seventh week of classes for standard calendar courses, no further changes in a student’s schedule are allowed, except in the case of a documented medical or family emergency. If a student fails to attend or stops attending a course without dropping or withdrawing, a grade of “F” will appear on transcripts for that course.

Withdrawal for Aid Recipients

Refunds of tuition and fee charges will be calculated based on the policy outlined below. If a student withdraws from all classes, institutional aid (Naropa grants and scholarships) and Colorado funded financial aid will be reduced in proportion to the reduction of tuition according to the schedule below. For example, if tuition is reduced by 50%, institutional and state aid will also be reduced by 50%. For the treatment of federal financial aid, please refer to the “Return of Title IV Funds” policy below.

Return of Title IV funds Policy

Withdrawals & Returns of Title IV Funds

Federal, state, and institutional financial aid funds are awarded to a student based on the assumption that the student will attend school for the entire semester for which the aid is awarded.

According to federal law, the financial aid office must recalculate Title IV financial aid eligibility (R2T4 calculation) for a student who withdraws from all classes, drops out, is dismissed, or takes a leave of absence prior to completing more than 60% of a semester. The financial aid office will calculate the amounts of “earned” (can keep) and “unearned” (must return) aid. Funds are then returned, to the appropriate aid programs, within 45 days from the Date of Determination (the date the institution determined that the student withdrew).

Withdrawal on or before the first day of classes

All cash disbursed to the student, and any aid on your Bursar account, are considered an overpayment of financial aid, and must be returned.

Withdrawal during the semester

Official Withdrawal

The student’s withdrawal date is the date the student began the withdrawal process by submitting the Withdrawal Request form or the Leave of Absence Request form to the Registrar’s Office (first step of process). Forms are located in the “Student Forms” section of the MyNaropa student portal, or by clicking here.

Unofficial Withdrawal

If the student leaves without notifying the university, the withdrawal date will be defined as the midpoint of the semester or the last date the student can be documented, by Naropa University, to have participated in an academically related activity.

Return of Title IV Calculation (R2T4)

Title IV or federal aid is earned in a prorated manner on a per diem basis, up to and including, the 60% point in the semester. Title IV aid and all other aid is viewed as 100% earned after the 60% point.

Post Withdrawal Disbursements (PWD)

If a student has “earned” funds, according to the Return of Title IV Funds calculation, that have not yet disbursed, the student may be due a Post Withdrawal Disbursement (PWD). All students who are eligible for a PWD will be notified in writing to their official Naropa student email address.

Naropa University may automatically use all, or a portion, of a student’s Post Withdrawal Disbursement of federal grant funds (Pell and SEOG) to cover remaining educationally related expenses. If there is a remainder of “earned” funds (credit balance), after the educational related expenses have been covered, the school will make a direct disbursement of these funds to the student within 14 days of the date the credit balance occurred.

If the Post Withdrawal Disbursement includes federal loans funds, Naropa University must receive permission from the student before it can disburse them. The student has 14 days from the date of the official PWD notification to accept/decline some, or all, of the loan funds. If a response is not received within this timeframe, the PWD loan disbursement will not be made.

Returning Federal Funds

If financial aid is received (other than College Work-Study) and the student terminates enrollment on or before 60% of the semester has elapsed, federal financial aid (Federal Direct loans, Perkins loans and Federal Pell and SEOG grants) must be returned according to the following schedule.

The school is responsible for returning any portion of the student’s unearned aid that was applied toward the student’s tuition and fees. This may create a bill for the student for any tuition and fees still owed after returning the necessary federal aid. The student is responsible for repaying any unearned federal aid the student received as a cash exchange check.

Example:

Kerry withdraws from Naropa on the 15th day of classes of the fall semester which consists of 103 days, total. Hence, Kerry completed 15 days/103 total days = 15% of the semester. Therefore, Kerry earned 15% of the Federal aid awarded. If Kerry received $4,000 in Federal aid, then the amount of earned aid is $4,000 x 15% = $600. Since $600 is earned aid, the remainder ($4,000 – $600) of $3,400 must be returned. Assume that institutional charges (tuition and fees) totaled $3,600 for the semester. The school is responsible for returning the lesser of:

The unearned Title IV disbursements ($3,400), or

The unearned percentage times institutional charges (85% x $3,600=$3,060)

In this case, the school returns $3,060 and the student returns $340 to the Federal Aid Programs. At Naropa, if the student withdraws anytime from the 8th through the 15th day of classes, they are entitled to an 80% reduction in tuition ($3600 x 80%), so tuition would be reduced to $720 ($3600 x 20%). Since Naropa originally applied $3600 of the student’s Federal aid to the tuition, and then returned $3060 to the Federal Aid Programs, Naropa now has only $540 applied to Kerry’s tuition. This means that Kerry owes Naropa $180 ($720-$540) towards tuition. If Kerry’s federal aid consisted entirely of loans, then Kerry may return the $340 owed to the Federal government in accordance with the terms of the promissory note. Kerry will need to contact the bursar’s office (tuition@naropa.edu) to settle the outstanding tuition bill, however.

Order of Refunds

Once the amount of federal aid to be returned is determined, it will be returned in the following order:

- Federal Unsubsidized Direct Loans

- Federal Subsidized Direct Loans

- Federal Perkins loans

- Federal PLUS loans

- Federal PELL grants

- Federal SEOG

- Other Federal Aid programs

Allowing Veterans to Attend or Participate in Courses Pending VA Payment

Background

Section 103 of Public Law (PL) 115-407, ‘Veterans Benefits and Transition Act of 2018,’ amends Title 38 US Code 3679 by adding a new subsection (e) that requires disapproval of courses of education, beginning August 1, 2019, at any educational institution that does not have a policy in place that will allow an individual to attend or participate in a course of education, pending VA payment, providing the individual submits a certificate of eligibility for entitlement to educational assistance under Chapter 31 or 33.

Pending Payment Compliance

Naropa University adopts the following additional provisions for any students using U.S. Department of Veterans Affairs (VA) Post-9/11 G.I. Bill® (Ch. 33) or Vocational Rehabilitation & Employment (Ch. 31) benefits, while payment to the institution is pending from VA. Naropa University will not:

- Prevent the student’s enrollment, or disenroll a student;

- Assess a late penalty fee to the student;

- Require the student to secure alternative or additional funding;

- Deny the student access to any resources (access to classes, libraries, or other institutional facilities) available to other students who have satisfied their tuition and fee bills to the institution.

However, to qualify for this provision, such students may be required to:

- Produce the VA Certificate of Eligibility (COE) by the first day of class;

- Provide additional information needed to properly certify the enrollment as described in other institutional policies.

If VA funds will not fully cover the balance due, the student is responsible for prompt payment resolution at that time this becomes known. The Student Financial Services department can assist the student with applying for other forms of financial aid and/or setting up a payment plan to resolve the balance.

GI Bill® is a registered trademark of the U.S. Department of Veterans Affairs (VA).